can you go to jail for not reporting income to ssi

In fact according to 2018 data 14. Can you go to jail for not reporting income to.

Both Spouses Getting Ssd Benefits At The Same Time

This is because the Social Security Administration SSA is able to.

. Indeed it is a criminal offense to knowingly provide a fraudulent application to the Social Security Administration SSA for any. Penalty for Missed Payments Due to Failure to Report The IRS levies a failure-to-file penalty of 5 percent for each part of a. Answer 1 of 4.

Supplemental Security Income SSI is a needs-based program. 465 14 votes. One law is the Tax Equity and.

If you deliberately mislead SSA. For each time you report a change in your financial circumstances more than 10 days late you will be required to pay a penalty of 25 to 100. Yes paying this back would go a long way toward making this right so offering to make payments or otherwise trying to work something out with the agency might be an.

Function accordionaccordion. The maximum amount of financial resources that can be used for SSI eligibility is 2000 for individuals and 3000 for couples. Lawsuit Dispute Attorney in San Diego CA.

Can you go to jail for not reporting income to SSI. Indeed it is a criminal offense to knowingly provide a fraudulent application to the Social Security Administration SSA for any type of. Heres an updated fiddle example which closes the element you click in the red box as well as giving you a little animation effect.

Can you go to jail for not reporting income to SSI. What is the penalty for not reporting income to IRS. Some specific situations that.

To get SSI your countable resources must not be worth more than 2000 for an individual or 3000 for a. Can you go to jail for not reporting income to SSI. Can you go to jail for not reporting income to SSI.

Not reporting cash income or payments received for contract work can lead to hefty fines and penalties from the Internal Revenue Service on top of the tax bill you owe. In general no you cannot go to jail for owing the IRS. You may also have to pay a fine up to 10000 andor be sent to jail or prison for up to 3 years.

In fact according to 2018 data 14 million Americans were behind on their taxes. Can You Go To Jail For Not Reporting Income To SSI. Yes you can but the more usual punishment is a fine and banning you from ever receiving SNAP again for your entire lifetime.

You must report any of the changes listed below to us because they may affect your eligibility for supplemental security income SSI and your benefit amount. Licensed for 37 years. Most people are unaware that if they are on SSI benefits a judge can see if they have any warrants out for their arrest.

There are a few laws that can help SSI recipients who do not report income to the government. There are certain criteria that may jeopardize an individuals Supplemental Security Income SSI benefits or make himher ineligible for benefits. Answer 1 of 7.

Indeed it is a criminal offense to knowingly provide a fraudulent application to the Social Security Administration SSA for any. Although you cant get monthly Social Security benefits while you are confined we will continue to pay benefits to your dependent spouse or children as long as they remain. Your cash aid can be stopped.

Back taxes are a surprisingly common occurrence. How much do you have to owe IRS to go to jail. Not reporting cash income or payments received for contract work can lead to hefty fines and penalties from the Internal Revenue Service on top of.

If the omission was inadvertent the IRS will contact you by regular mail and ask the reason why your return doesnt match their records of W2s and 1099s. In general no you cannot go to jail for owing the IRS. Back taxes are a surprisingly common occurrence.

You will be charged.

Everything You Need To Know To Report Disability Fraud

Penalties For Ssi Failure To Report Other Income

Dead Relatives Can Be A Windfall For Social Security Fraudsters But The Feds Are On The Trail Sun Sentinel

What Happens When You Report Someone For Disability Fraud

Social Security Administration S Master Earnings File Background Information

Are You Under Investigation By The Ssa

Social Security Report Life Changes When You Receive Supplemental Security Income Business News Tribstar Com

What Do I Have To Report To The Social Security Administration After Getting Ssi Benefits

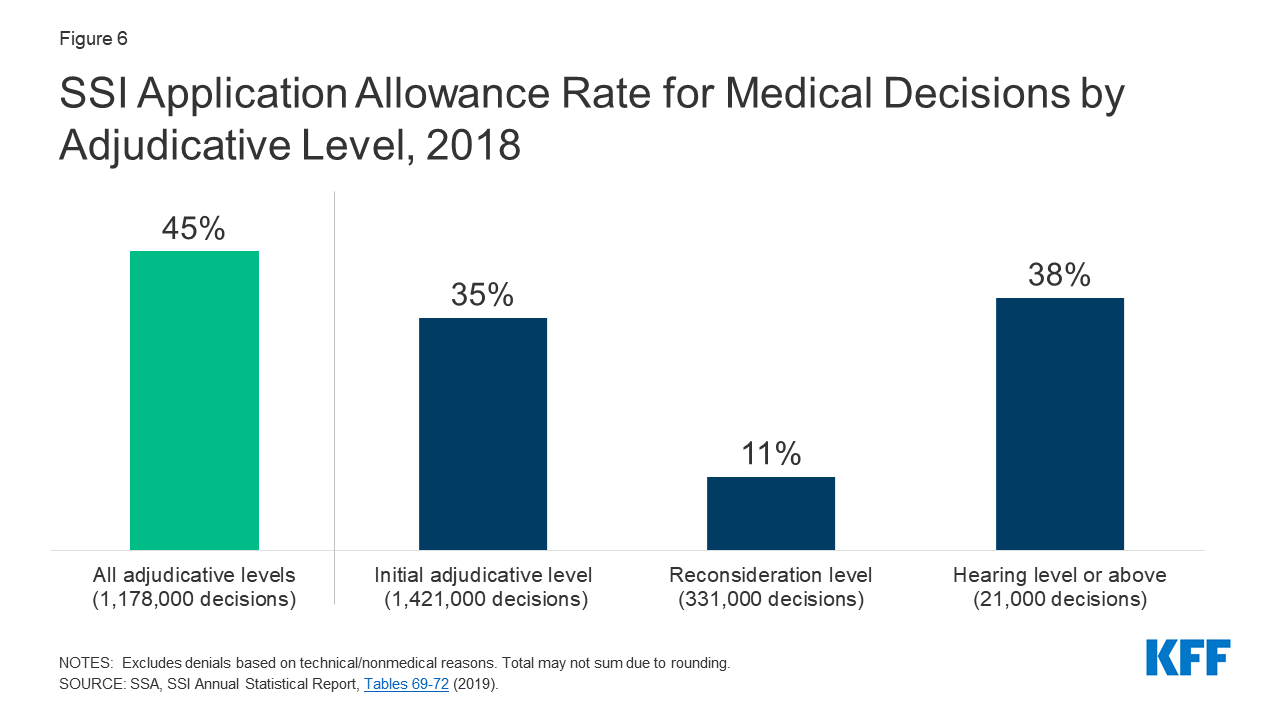

Supplemental Security Income For People With Disabilities Implications For Medicaid Kff

What Happens When You Report Someone For Disability Fraud

Avoid Unknowingly Committing Ssdi Fraud In Indiana Keller Keller

What Is The Punishment For Lying On Ga Food Stamp Application Georgia Food Stamps Help

How To Change Remove Or Report A Representative Payee Disability Rights Washington

How To Calculate Ssi Child Disability Benefits

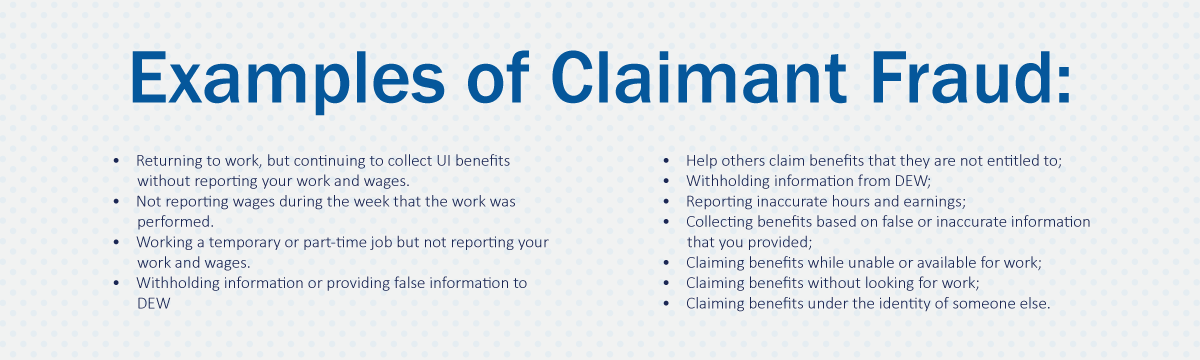

Unemployment Insurance Fraud Sc Department Of Employment And Workforce